Expand Your Investment Horizons with Cambridge Mortgages.

We offer a comprehensive range of investment options to suit your unique goals and risk tolerance. Explore a variety of UK and offshore investment opportunities, including:

- Investment Trusts

- Unit Trusts

- OEICs

- Endowment Policies

- Investment Bonds

- ISAs

- Annuities

Risk and Reward

Understanding Your Risk Tolerance: The Key to Successful Investing.

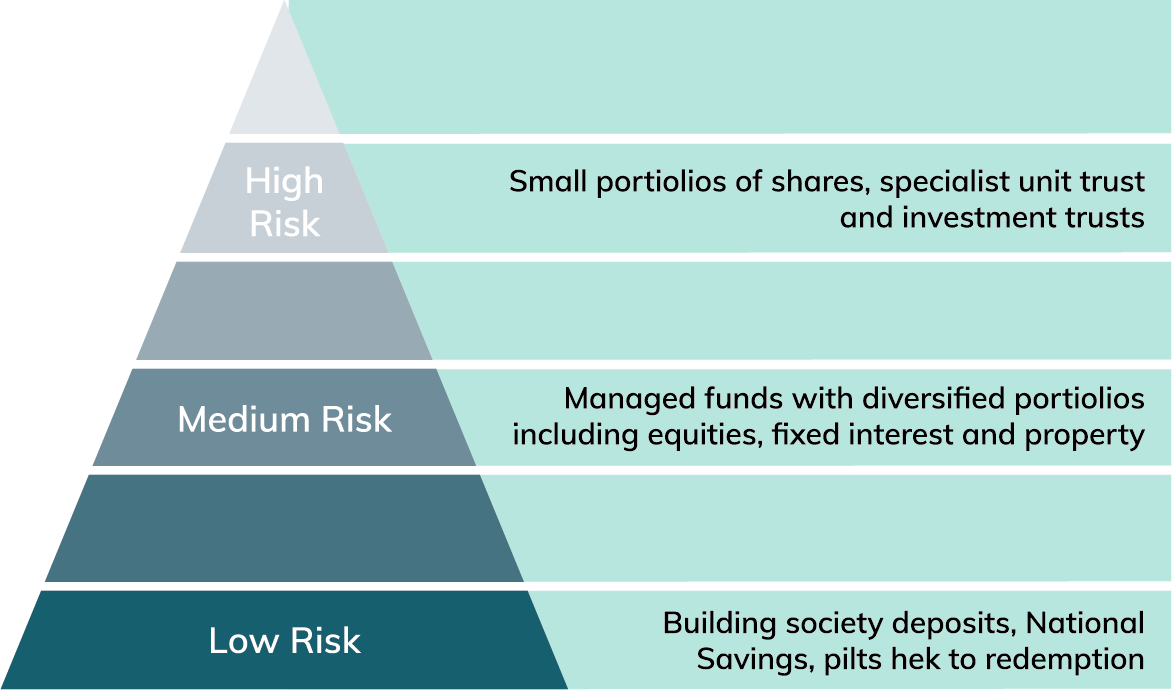

Everyone has a different comfort level with risk. Before embarking on your investment journey, it's crucial to identify your risk tolerance. This will guide you towards investment options that align with your financial goals and overall peace of mind.

Risk Profile

- Risk Categories as a Guide: While these categories offer a general framework, your financial advisor may use slightly different terms.

- The Risk-Reward Relationship: Higher potential returns often come with a higher risk of losing money. Conversely, lower-risk investments typically offer lower returns.

- Investment Time Horizon: Long-term investments, like those in stocks and shares, are generally better suited for handling market fluctuations. Advisors often recommend a 5-year investment timeframe for these types of assets.

- Diversification Matters: Spreading your investments across different asset classes can help mitigate risk. Putting all your eggs in one basket can be riskier.

Past performance isn't a crystal ball: What happened in the market before doesn't guarantee what will happen in the future.

Investments can go up or down: There's always some risk involved. The value of your investments and any income they generate can fluctuate.

Taxes are a moving target: The tax benefits you receive depend on your specific situation and can change over time.

Currency fluctuations can be tricky: Exchange rates can affect the value of overseas investments.

Specialty funds pack a bigger punch (and risk): Funds focused on specific sectors might be riskier due to potential market volatility.

Knowledge is power: Make sure you review the Key Features Document and other information before making any investment decisions.

Unit Trusts

Unit trusts are a popular way for individuals to invest in the stock market. They work by pooling money from many investors into a single fund, managed by a professional. This offers several benefits:

Spreading Your Risk: Your investment is diversified across a range of assets, minimizing risk compared to putting all your eggs in one basket.

Cost-Effective: Unit trusts allow you to access a professionally managed portfolio without a high minimum investment.

Expert Management: Experienced fund managers handle the buying and selling of assets within the trust, leveraging their expertise for your benefit.

Variety and Tax Considerations: A wide variety of Unit Trusts exist, catering to different investment goals and risk tolerances. It's important to note that while the Trust itself may not incur taxes on its internal transactions, you may be liable for taxes on dividends received and when you sell your units.

OEICs

What is an OEIC?

- Open-Ended Investment Companies are often referred to as the modern day and flexible equivalent of the unit trust. They combine the elements of unit trusts and Investment trusts enabling you to pool your investments along with other investors. This helps to spread the risk and enables you to take advantage of the skills of a professional managing the fund.

- OEICS are regulated by the FCA. The rules are based on specifically written company law, whereas unit trusts are based on old trust law.

- OEICS have a single price for buyers and sellers and the charges are shown separately. A unit trust has a separate buying and selling price (bid/offer spread).

- The OEIC share price directly reflects the underlying assets of the portfolio

- An Umbrella Fund structure, which means that there are different classes of share. Each sub share fund can be invested in a different area if required.

Investment Trusts

An Investment Trust is a company that invests your money in a variety of other companies' stocks. Instead of buying individual shares, you invest in the Trust, which spreads your risk across different holdings. This means your investment isn't tied to the performance of just one company.

Think of it like this: Imagine putting all your eggs in one basket. If that basket falls, you lose everything. An Investment Trust helps you spread your eggs across several baskets, minimizing the impact of any one company's performance.

Tax Considerations: Similar to individual stock purchases, investing in Investment Trusts carries similar tax implications.

ISAs

Individual Savings Accounts (ISAs) are available to all UK residents over 18 years of age, 16 years of age for the Cash ISAs. They benefit all taxpayers, as any income or capital gains received from investments held within an ISA do not have to be declared to the tax man.

ISAs can invest in cash or in stocks and shares (including unit trusts, investment trusts, Open Ended Investment Companies, some fixed interest securities, or any share quoted on a stock exchange recognised by H M Revenue and Customs.)

The overall ISA limit has increased to £11,880 for the 2014/2015 tax year. Up to £5,940 can be placed within a Cash ISA and the balance (up to £11,880) into a Stocks and Shares ISA. You can take out a Stocks & Shares ISA and a Cash ISA in the same tax year subject to the overall limit applicable to that tax year. For example if you placed £2,000 in a Cash ISA, you could then invest the balance of £9,880 in the Stocks & Shares ISA.

Investment Limits

Cash ISA's - Cash ISA's are widely available with different interest rates. It is a good idea to shop around for the best Cash ISA rates. It is important however to understand the conditions attached to those rates, for instance access may be restricted in order to achieve that particular rate.

Stocks & Shares ISA- Assuming you haven't invested in a Cash ISA in the same tax year you can invest £11,880 in the current year (2014/2015) in a Stocks & Shares ISA.

THE VALUE OF INVESTMENTS AND INCOME FROM THEM MAY GO DOWN. YOU MAY NOT GET BACK THE ORIGINAL AMOUNT INVESTED.

Government Gilts

Government backed stock, known as 'Gilts' are loans made to the Government by in effect the investors. Much of the national debt is comprised of Government Gilts, so when the Government needs to 'borrow' more, it simply issues a new Gilt.

Gilts provide income derived from interest payments and a final redemption. Inflation erodes away at the true value of the Gilts redemption, whilst interest rates will make the Gilts income appear more or less attractive. Broadly speaking when interest rates rise the value of the Gilt will fall and vice versa. Many professional investors and fund managers invest part of their portfolio in Gilts because Gilts can help them to spread risk and/or provide income.

What is ESG Investing?

ESG stands for environmental, sustainable and governance.

ESG investing goes beyond just financial returns. It allows you to align your investments with your environmental, social, and governance (ESG) principles, making a positive impact while growing your wealth.

At Cambridge Mortgages, we combine our proven investment strategies with your ethical considerations. We believe you don't have to sacrifice performance to invest sustainably. A growing number of ESG options offer competitive returns alongside positive social and environmental impact.

Ready to make a difference with your investments?

Contact us today, and we'll connect you with an advisor specializing in crafting ESG solutions that align with your financial goals and values.